Project Info

Client

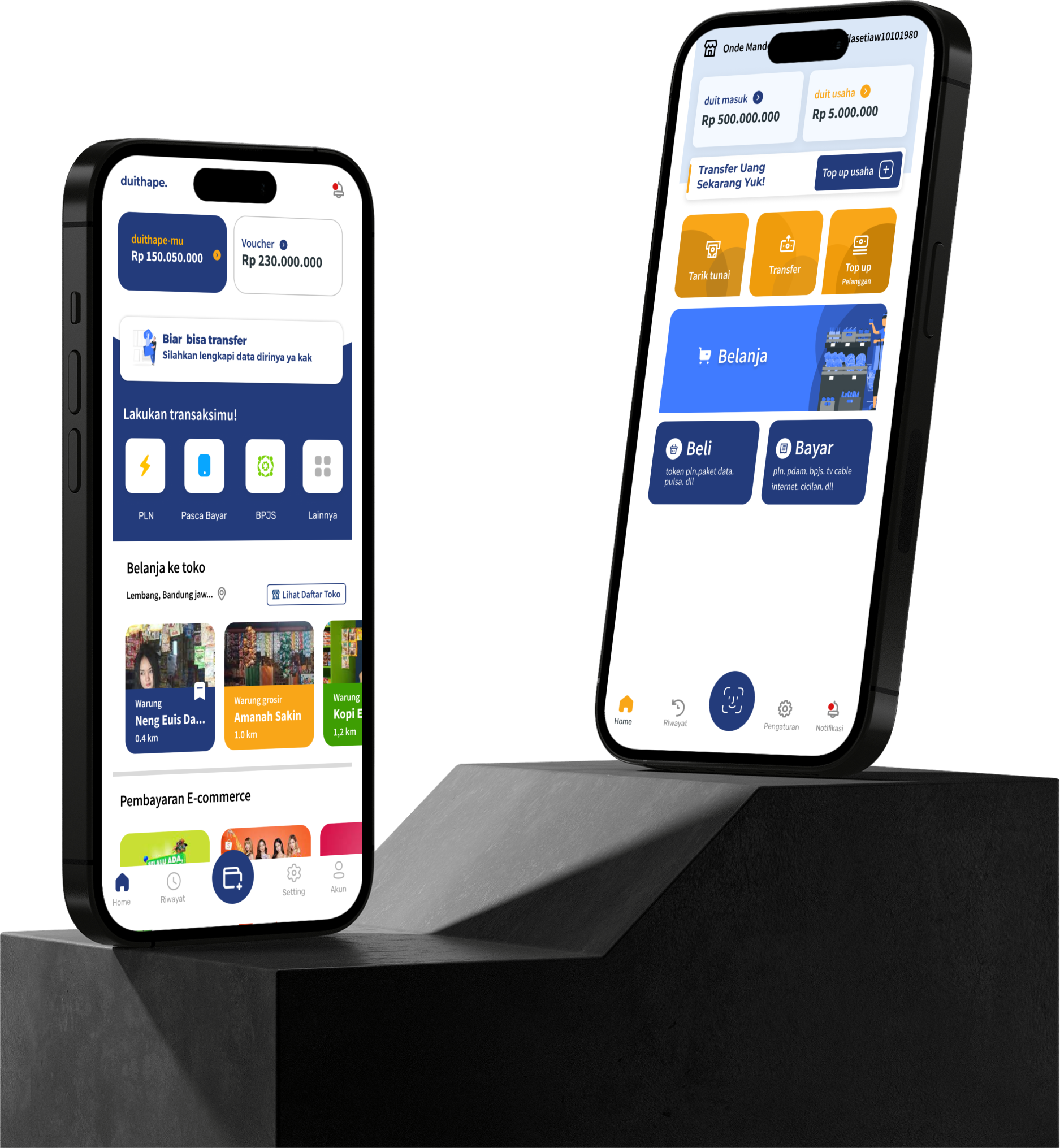

DuitHape

Project

DuitHape Fintech Mobile App: Fintech App for Unbanked People.

Tech Stack

NestJS, React Native, Alibaba Cloud Kubernetes, Apsara DB (MySQL), Apsara DB Redis, OSS bucket, AWS Face Recognition

Challenge

In 2021, the ownership rate of financial institution accounts in Indonesia stood at around 49% among adults aged 15 and above. This signifies that less than half of Indonesia's adult population had the privilege of accessing formal financial services via conventional banks or financial institutions. Consequently, this stark disparity in access to financial services results in hardships for individuals in rural areas, particularly concerning payment processing, savings, and person-to-person transactions.

Our Solution

In response to this issue, we have developed a fintech application tailored to offer essential financial services to the unbanked demographic. Our primary focus revolves around delivering fundamental services, notably PPOB (Payment Point Online Banking), a widely embraced method in rural areas for purchasing phone credits. Additionally, our core features include facilitating salary disbursements for individuals in these underserved communities.

The Solution

Our fintech application is designed to bridge the financial services gap for the unbanked population in Indonesia. It addresses the pressing need for basic financial services that are often inaccessible to those in rural areas. Here are the key features:

In essence, our fintech solution aims to improve the lives of unbanked individuals by offering them access to vital financial services, ultimately fostering financial inclusion and equality.

The Impact

Our fintech application has made significant strides since its

inception. It is now widely recognized as one of the key players in Indonesia, catering specifically to the

unbanked population. The app has become an essential tool for many, providing access to vital financial

services that were previously out of reach.

Notably, our efforts have garnered international attention. In Ikata, Japan, the local prefecture has taken

note of our success and the positive impact we've had on financial inclusion. As a result, they have decided

to adopt a similar system and have chosen to license our technology through Duithape. This recognition further

underscores the effectiveness and potential for scalability of our solution on a global scale. We're proud to

be at the forefront of driving financial inclusion and making a difference in the lives of the unbanked.

(documentation: https://www.youtube.com/watch?v=NMn8npsdWnc)